Have you ever wondered how the public sector processes payments? The truth is, it’s pretty similar to running a private business, although government agencies need to offer more payment options to cater to the different needs of the public.

Let’s take a closer look at payment processing in the public sector.

How the Public Sector Processes Payments

Check Payments

Checks are still one of the most widely used forms of payment in the United States and it is governed by Articles 3 and 4 of the UCC. Over the years, check collection and return processes in the United States have been improved to make sure that they are in line with the Federal Reserve’s regulations.

Credit Card Payments

Credit cards are still the most widely used form of electronic payment in the United States with billions of credit card transactions processed every year.

Visa, Master card, and American Express are three of the largest credit card providers in the country, and they are duly licensed by the Federal Reserve to be able to process payments made for the public sector.

Electronic Payments

To adapt to the evolution of technology, the public sector has started accepting consumer electronic payment transactions including fund transfers through ATM, credit cards, POS networks, and ACH.

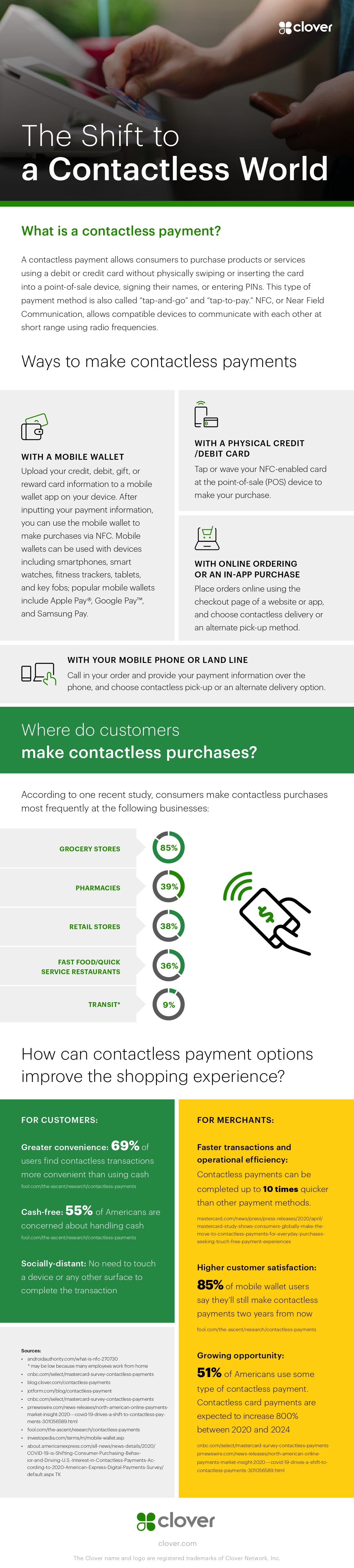

Infographic created by Clover, a credit card processing company

This form of payment requires payment processors that handle high-risk merchant accounts, although these transactions are governed by the Electronic Fund Transfer Act of 1978.

Cash Payments

A lot of people still choose to pay cash to government agencies, which is why the United States Department of the Treasury’s Bureau of Engraving and printing continues to produce Federal Reserve notes that are then issued by the 12 Federal Reserve banks throughout the country. These banks also offer cash services to more than 9,600 different financial institutions in the United States.

Deposit Payments

The Federal Reserve banks with 12 specialized facilities and 25 branches accept a wide variety of payment services, catering to deposit-taking institutions. These services include check return and collection, electronic transfer of funds and securities, coin and currency distribution, and ACH payment processing.

The Federal Reserve, however, charges fees for these payment services that are offered to deposit-taking institutions, as stipulated in the Monetary Control Act of 1980.

Other Financial Institutions that Work with the Public Sector

There are also institutions that offer payment services to the public sector but are not necessarily banks (World Bank Group, 2017). These include bank card companies, the United States Postal Service, and other “non-bank banks.”

Also called limited-service banks, these financial institutions are capable of offering loans or accepting deposits, but they cannot do both, which is why they are called non-bank banks; they don’t meet the legal requirements defined by the Bank Holding Company Act of 1956.

With the introduction of automated payment processing systems, more government agencies have also started adopting newer methods that allow for more efficient billing, payments, data collection, and disbursements within the public sector.

With the continuous evolution of technology, we can only look forward to more payment processing options in the future

Citation

World Bank Group. (2017, November 7). Nonbank Financial Institution. World Bank. https://www.worldbank.org/en/publication/gfdr/gfdr-2016/background/nonbank-financial-institution